Western "economists" and "analysts" are a very interesting breed--they carry worthless pieces of paper called degrees in "economics" from universities where people who never worked a day in life on real job teach them how real economy works, and they love hyperbole. Like this:

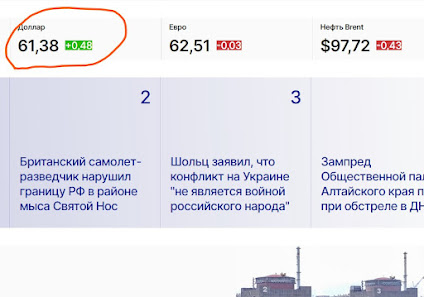

As you all know I don't deal with this voodoo which Western economics is because I don't deal in magic, occult and magic spells, aka Wall Street. But as always, for anyone who wants to glimpse at economic reality of the world it is worth noting that Ruble was revolving around 60-61 (Hey, Joe, where is those promised 200 for a dollar) for a duration of the last week or so and today it closed at:

Of course, the piece above reports in a proforma manner this piece of news:

Allegedly it is all about divestment and ridding off the "toxic" Russian assets. Sure. But something tells me that there is a lot more to this story than Reuters puts on, and the issue here is very simple: in the long run real economy on which the financial system rests, not the stock market, wins. And while I am no specialist in securities--I am simply not that interested in speculation in general--I give you one example to illustrate the issue.

You try to kick them out, but no--they just don't want to. You see, when one's life is dependent on real, tangible things, not some funny papers--sanctions or not--try to kick them out. And mind you, Russia is imposing her own sanctions on the "unfriendly" countries. But, getting back to Ruble, it is absolutely not a secret that Russia since June went public stressing that:

No comments:

Post a Comment